In this article, we will delve into the Pawn Shop market, providing insights into its size estimates for the year 2023. Additionally, we will examine the demand-supply scenario, conduct a competitive analysis, and present growth projections through the year 2030. By exploring key players in the industry such as Borro Private Finance, KVP Group, EZCORP INC., and American Pawn Company, we aim to provide you with a comprehensive overview of this thriving market.

Pawn Shop Market Size Estimates for 2023

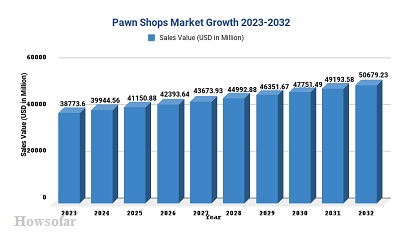

As we approach the year 2023, the Pawn Shop market is anticipated to witness significant growth. With its ability to offer short-term loans secured by collateral, pawn shops continue to attract a wide range of customers. The market size is projected to expand substantially, reflecting the increasing demand for quick and accessible financing options.

Demand-Supply Scenario in the Pawn Shop Market

The demand for pawn shop services arises from various factors such as economic conditions, consumer spending patterns, and the availability of traditional banking services. The ability to obtain loans without extensive credit checks makes pawn shops a viable option for individuals facing financial constraints.

Simultaneously, the supply side of the Pawn Shop market is driven by the number of pawn shops operating in different regions. The growth of this industry is attributed to the rising number of pawnbrokers establishing their businesses to cater to the increasing demand for collateral-based loans.

Competitive Analysis of Key Players

Borro Private Finance: Borro Private Finance is a prominent player in the Pawn Shop market, offering high-value loans secured by luxury assets. With a reputation for professionalism and reliability, Borro Private Finance has captured a significant market share.

- KVP Group: KVP Group has emerged as a leading name in the Pawn Shop industry, specializing in providing loans against gold and diamond jewelry. The company’s expertise in evaluating and appraising precious metals has contributed to its success.

- EZCORP INC.: EZCORP INC. operates an extensive network of pawn shops across multiple countries. Their customer-centric approach, combined with a diverse range of financial services, has positioned them as a strong contender in the market.

- American Pawn Company: American Pawn Company has built a solid reputation by offering fair loan terms and excellent customer service. Their focus on building long-term relationships with clients has enabled them to thrive in a competitive landscape.

Growth Projections Through 2030

Looking ahead to the year 2030, the Pawn Shop market is expected to continue its upward trajectory. Factors such as increasing consumer awareness, the convenience of pawn shop services, and the prevalence of economic fluctuations contribute to this positive outlook.

As the industry evolves, pawn shops are likely to adopt advanced technology, providing streamlined services and enhanced customer experiences. The market’s growth will be fueled by the integration of digital platforms, allowing customers to access loan information, manage their accounts, and conduct transactions online.

Conclusion

In conclusion, the Pawn Shop market is poised for substantial growth in the coming years. With favorable market conditions and the presence of key players such as Borro Private Finance, KVP Group, EZCORP INC., and American Pawn Company, this industry continues to meet the financial needs of individuals in search of collateral-based loans. As the demand-supply dynamics evolve and technological advancements shape the landscape, the Pawn Shop market is set to thrive, providing accessible financial solutions for years to come.

Remember, your support is invaluable in helping me create more free prompts. If you enjoyed this article, consider supporting me on Buy Me a Coffee. Thank you for your generosity and encouragement!

FAQs

1. What is the role of pawn shops in the financial industry?

Pawn shops provide short-term loans to individuals in exchange for valuable collateral. They offer an accessible and convenient lending option, particularly for individuals with limited credit options or facing financial emergencies.

2. How do pawn shops determine the value of collateral?

Pawn shops employ expert appraisers who assess the condition, market value, and demand for the item being used as collateral. Factors such as rarity, brand reputation, and current market trends are taken into account to determine the value of the collateral.

You can also get The Rising Demand for E Pharmacy Beauty and Personal Care (BPC) Market